Not only did the 31st December 2019 signal the end of a buoyant real estate year, it was also the conclusion of a decade in which we have witnessed unbelievable capital gains for the majority of homeowners and also unbelievably low mortgage interest rates which have paved the way for many to finance their way on to the property ownership ladder. New Zealand rounded off the decade with the highest number of residential properties sold for the month of December in three years and price rises in 15 out of the 16 regions nationwide, according to data from the Real Estate Institute of NZ.

We repeat below some of the pertinent comments made by the Chief Executive of the Real Estate Institute of NZ, Bindi Norwell. For the purpose of analysing the REINZ’s statistical data information, it should be noted that the Wellington District includes the Kapiti Coast and Wairarapa.

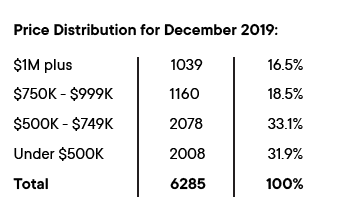

- The number of residential properties sold across NZ in December 2019 increased by 12.3% from the same time last year to 6,285 up from 5,596 (689 more properties). That’s an additional 22 houses sold each day around the country in December – which is not an insignificant number.

- With insufficient properties on the market to satisfy buyer demand, it suggests that buyers are being more definitive when it comes to purchasing as they are aware of the need to move quickly on properties and areas with high demand. This is backed up by the decrease in the median number of days to sell which is at its lowest point for three years.

- December saw 15 out of 16 regions with annual increases in the median house price (West Coast being the exception) and five regions with record median prices reflecting the continued uplift in residential property prices that we’ve seen for a number of months now.

- Wellington was a standout region in December with four areas seeing new record median prices; Kapiti Coast District ($675,000), Masterton ($477,000), Porirua City ($775,800) and South Wairarapa District ($625,000) showing the continued strength of the capital city’s property market.

- In December the median number of days to sell a property nationally decreased by four days from 35 to 31 when compared to December 2018 – the lowest days to sell in three years. This figure was two days fewer than the November 2019 figure of 33 days.

- The number of properties sold around the country for one million dollars or more during 2019 increased by 1% with 10,869 million dollar plus properties sold (up from 10,761 in 2018), but it still hasn’t surpassed the 2016 record when 11,661 million dollar plus properties were sold.

- Million dollar sales in the Wellington region increased last year by 27% (from 758 to 963); an additional 205 properties.

From the above data it can be seen that New Zealand has witnessed a strong residential real estate market over the last year and at Tommy’s, we see no reason why this won’t continue into the foreseeable future. The price distribution above should give confidence to home sellers with not only an increase in sales at the million dollars plus level but also, that nationwide there is a strong demand for lower priced more affordable property with 65% of the sales being in the $749,00 and below bracket. This situation applies in Wellington City and suburbs as much as it does anywhere else in the country.

The catch cry from most real estate agents today is that they have buyers with approved finance looking to buy and as we have experienced last year and beyond, demand is exceeding supply. Tommy’s is no exception and with the systems we have in place, we are well equipped to offer home sellers the right advice and to implement a marketing programme that will capitalise on current market conditions and attract top price. Multiple offers are quite common and it is important that these are handled in a manner that is fair to all parties but always with the homeowner’s interests being our moral and legal priority.

Buying, selling or renting, we invite you to call a Tommy’s agent without obligation.

Thankyou for an amazing information explained by facts and figures. Great Effort I must Say!