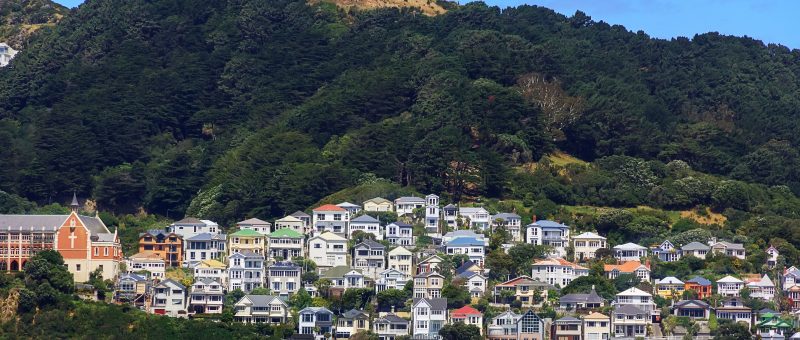

Will the Reserve Bank raising the Official Cash Rate this month and in April set back the housing market just as it’s starting to stabilise in Wellington?

At one stage it was feared the OCR would jump .75 points because of Reserve Bank fears about the rate of inflation.

But economists now think it will be closer to .50 points.

Whatever the increase, Tommy’s Sales Director Nicki Cruickshank is optimistic that further interest rate rises won’t dampen renewed buyer interest in Wellington houses.

“It feels like the market has hit a flat period – which is giving buyers more confidence to return to the market,” she says.

“Open home attendances since mid-January have been the best we have seen in over 12 months.

“There are a lot of first-home buyers in the market at the moment. Those that tried last year and could not get finance to the levels they needed are back!

“And there are signs of some investors returning to the market, bearing in mind they used to be approximately 25 per cent of the Wellington market — and over the past year have been virtually zero per cent.”

In the meantime, Nicki believes buyers are factoring the next OCR hike into their decision-making.

“Everyone is hoping it won’t be at the level first anticipated, so anything under .75 will be a bonus,” she says.

“The banks are always stress-testing potential buyers at a rate generally two per cent higher than the current rate to make sure they can absorb any increase.”

She points out while buyers are facing higher interest rates, lower house prices are helping to soften the blow.

“And there are signs that hopefully the rates will start to come down.

“Whenever you see banks offering lower rates for those four-to-five year loans, you can expect shorter terms to come back fairly quickly.”

Despite the OCR rises, Nicki believes buyers were much more cautious last year than this year.

“Things appear to be more stable at the moment,” she says. “No one likes fast-rising and fast-falling markets — they create too much uncertainty.

“There comes a time when buyers just want to get on with things when they accept what interest rates will be, and we have to remember that the 100 year average is around seven per cent – which is where we are now.

“The much lower rates from last year were very unrealistic. As long as you are fully aware of what is happening in the market and the economy, then you can plan for any changes.”

Nicki expects the market to “fairly flat” in the short term.

“There are still fewer houses selling but that’s to be expected after the highs of last year.

“Good houses always sell in Wellington no matter what the market, and people will always want to upsize or downsize,” she says.

“With all the weather events, Wellington is becoming an attractive place to live. Who knows — maybe we might see a surge of Aucklanders wanting to move here!”

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal