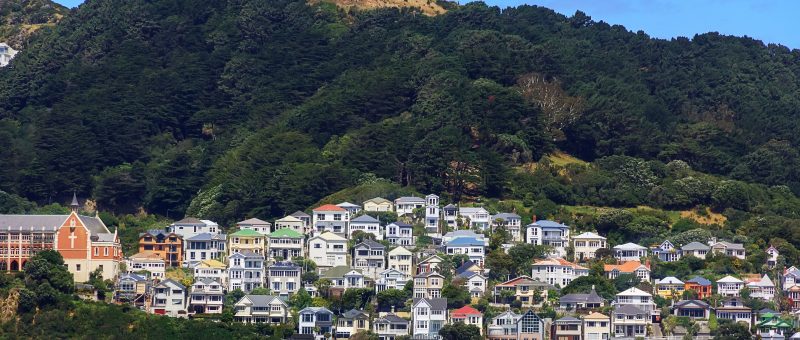

Wellington Market Update | March 2024

A significant surge in houses for sale in Wellington means that sellers need to put their best foot forward, and buyers must stay on their toes. This is the advice from Tim Clark, Sales Director at Tommy’s Real Estate, following the release of data from the Real Estate Institute of New Zealand (REINZ), which showed a staggering 148 per cent increase in January listings across the region.

“The Wellington market has seen a large number of new listings, and at Tommy’s Real Estate, we have a large portion of those,” says Tim. “So there is plenty of choice for buyers right now, and sellers need to make sure they put their best foot forward to capture the buyers’ attention. It is more important than ever for sellers to price, present, and market their properties with a great agent – sellers are now competing with other sellers.”

However, while buyers have more choice, Tim cautions that this abundance can sometimes be a bit of a trap. “It can make it harder for buyers to make a decision — they can find themselves forever looking rather than buying. So, if you like a property and you’re happy with the information provided, then make an offer.”

Tim notes that the market is “much busier” than this time last year, with more offers per sale, busier open homes, more stock, and more sales. “Also, there does seem to be more confidence and certainty across the board. The first-home buyer market remains strong, with a lot of interest in homes under the $1.1 million mark, especially when the property is well presented. And the most recent announcement around interest deductibility will bring investors back to the market sooner than expected.” Tim doesn’t expect the prospect of the Official Cash Rate staying high will hinder sales.

“Most buyers we work with have a pre-approval, which will be up to three months old, and so current interest rates have been factored into this buying budget already. They are also keen to buy before their pre-approval expires – we hear from buyers that renewing an expired pre-approval takes a lot of time, energy, and paperwork on their part. We’re also seeing buyers looking to enter the market now, before prices may increase.

“Most buyers we work with have a pre-approval, which will be up to three months old, and so current interest rates have been factored into this buying budget already. They are also keen to buy before their pre-approval expires – we hear from buyers that renewing an expired pre-approval takes a lot of time, energy, and paperwork on their part. We’re also seeing buyers looking to enter the market now, before prices may increase.

“Interestingly, a couple of the major banks have lowered the rates on some of their fixed rates, so perhaps this is a sign of things to come – it will be interesting to watch.”

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal