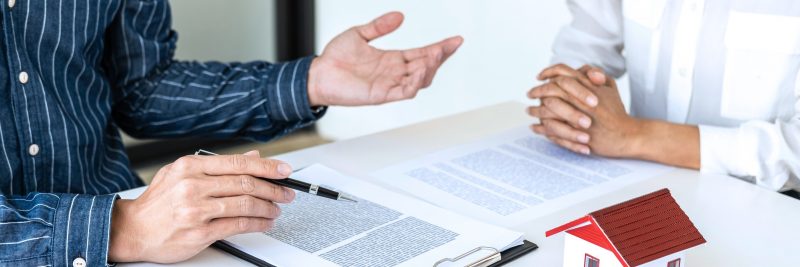

Entering into a legal contract of any description is unlikely to be a regular occurrence for most of us so there will be times when it is prudent to obtain expert advice before entering into a legal and binding contractual relationship. Buying or selling a house or commercial property is no exception and unless you are familiar with this process, we recommend the involvement of specialist legal consultation in particular. If the property is an investment property, there are additional considerations pertaining to taxation and tenancy laws that a new buyer should be aware of. In this blog post, we will briefly cover some areas in the buying and selling process you may need to seek advice on.

Agreement for Sale and Purchase: Most property transactions in New Zealand are consummated on a standard Agreement for Sale and Purchase. This is a document compiled through the collaboration of the Real Estate Institute of NZ and the Auckland District Law Society. The document is regularly updated, and real estate practitioners are currently using the 11th edition. The document runs to several pages, and we recommend both buyers and sellers seek legal guidance before entering into an unconditional sale using this document.

The Agreement should be the catalyst for a trouble-free transaction with both parties having a clear understanding of their obligations. Home sellers are especially urged to be aware of the vendor warranties and undertakings section of the agreement to ensure they are compliant. The document covers a multitude of issues but used correctly and understood by both parties it serves the legal and real estate industries well. Tommy’s recommends both buyers and sellers familiarise themselves with the contents of this document when first listing for sale or when starting to look for property as a serious buyer. Both parties can then progress with confidence when an offer is tabled.

Checking Title and LIM Reports: It is prudent to obtain both a title search and Land Information Memorandum report when buying. From these documents your solicitor will identify any issues that could affect your buying decision regarding the legal status of the title and outstanding building permits or Code Compliance Certificates.

Specialist Reports: It would be unusual to require a range of reports from independent professionals, but buyers should consider whether or not they require a builder’s report, an engineer’s report, or advice from any other tradesperson. A builder’s report is the most commonly used trade report and should highlight any major issues. Don’t expect a report on an old property to be blemish free though. Even with careful ownership and regular maintenance, wear and tear take their toll over time.

Valuation Report: This may be a requirement of the financial entity financing a property purchase depending on the buyer’s ratio of borrowing to financial input. Often though, the selling price and agents’ opinion will suffice.

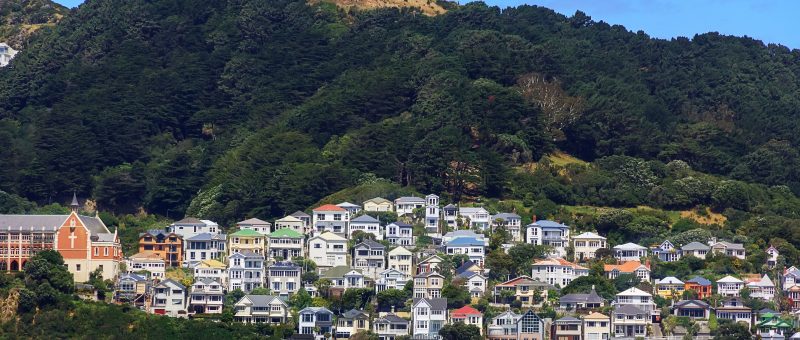

Purchasing an Apartment: Purchasing an inner-city apartment has become a viable option for many first homeowners in recent times. Most apartments are governed by a body corporate which has a set of rules any new buyer should acquaint themselves with. A new buyer moving into a body corporate apartment should also peruse recent minutes of body corporate meetings and have a clear understanding as to what their liability is in connection with ongoing body corporate fees and any maintenance items that may have been agreed on but not yet carried out. A body corporate is a proven and successful system for managing apartment buildings, but they do come with some restrictions, and we urge potential buyers to seek legal advice when buying.

Buying From Plans: Buying from plans and specifications is quite common and gives buyers more time to save additional purchase funds. Contracts of this nature do have their own peculiarities though such as ‘Sunset Clauses’ which can give the developer an opportunity to cancel a contract if the project is not completed by a specific date. Most contracts (but not all) are fixed-price contracts, but this is an area that can be a trap for the uninitiated, so we recommend legal advice once again.

Brightline Test: Described by some as a capital gains tax, the Brightline Test was established to discourage property speculation by taxing profits from short-term property ownership. There are certain exemptions including family homes which are not subject to the Brightline Test but there have been homeowners unexpectedly caught by this legislation. If you are selling, we recommend homeowners clarify their personal liability (if any) with their legal advisers.

There are countless other areas where independent advice is advised e.g., using an established mortgage broker is one that comes to mind. Buying or selling, your Tommy’s agent will assist where possible – but with specialist and legal matters, we strongly advocate seeking the best advice possible. Doing so and capitalising on the experience and guidance of your agent should ensure a seamless transaction and add to the joy of owning your new property purchase.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal