As was widely predicted, the Reserve Bank have adjusted the Official Cash Rate upwards by 0.25% at the latest review on 6th October 2021.This was the first adjustment to the OCR since March 2020 and will come as no surprise to most market followers. Further increases seem likely to occur at subsequent reviews. As was expected, the major lending institutions were quick to adjust mortgage rates on the back of the OCR adjustment and homeowners who are heavily mortgaged will be watching developments with interest and possibly some concern.

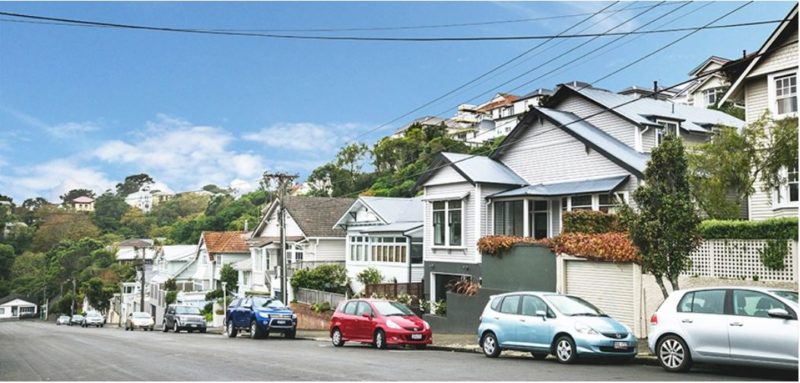

Like most of the country, the greater Wellington area is still witnessing a market where demand exceeds supply so any minor interest adjustments are likely to have negligible impact on buyer demand. The median house price in the Wellington area (including the city and suburbs and also the Hutt Valley, Kapiti Coast and Wairarapa) was $875,000 as at 31st August 2021 while in Wellington City alone, the median price was $1.1m. Despite the uncertainty of Covid, interest rates, and other market factors, Tommy’s suggest these figures will be our future benchmark and expect prices to hold up in the coming months.

As we see it, the supply of properties will continue to be tight although new builds now under construction or on the drawing board will eventually ease some of this pressure. There are a number of apartment developments underway, and these are proving popular with first home buyers. When we add to the current demand for residential property an estimated further 30,000 people wanting to return home and vying for MIQ space though, the imbalance of supply v demand seems to be with us for some time to come making for an appealing market place for home sellers.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal