Almost daily we are reading of record sale prices for residential dwellings throughout New Zealand with few locational exceptions to this trend. Most areas of New Zealand have recorded exceptional capital gains for those fortunate enough to be homeowners in this era. In the latest press release from the Real Estate Institute of NZ (REINZ) CEO Jen Baird stated, “Median prices for residential property across New Zealand increased by 25.5% from $677,400 in August 2020 to a record $850,000 in August 2021”. September figures are not available as we prepare this article, but it would surprise if that trend has not continued.

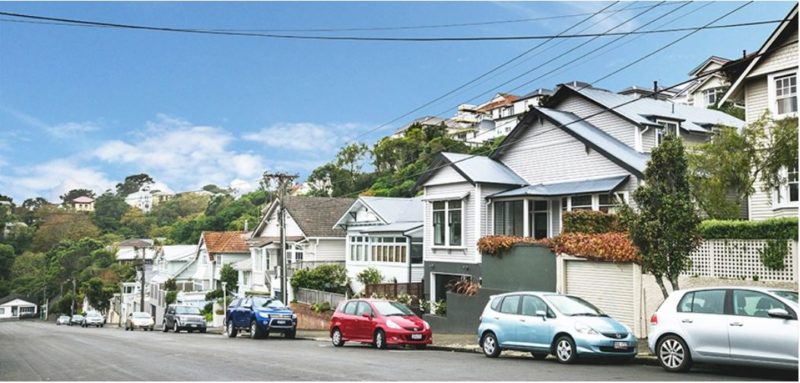

Wellington’s Regional Director of the REINZ is Mark Coffey. Mark is also a Tommy’s franchise owner/operator in the Hutt Valley and his report to the national body and membership follows. “In August, the median house price in Wellington (including the city and suburbs, Kapiti Coast and Wairarapa) increased 21.5% year-on-year to $875,000. Wellington City reached a record median house price of $1,100,00; up 35.4% from the same time last year. The Covid 19 alert level 4 lockdown saw online buyer enquiry increase with people having more time to browse pre-listed properties. The level of stock in Wellington was low in August with a 7.1% decrease year-on-year leaving just 5 weeks inventory available to prospective purchasers”. This brief but concise report accurately summarises the state of the Wellington, Hutt Valley and Kapiti Coast housing market.

The number of residential properties sold nationally in August decreased when compared to the same time last year from 7,828 to 5,753; the lowest level of August sales since 2014. The Wellington region was no exception to this trend. The shortage of available stock, the inability of people to physically view properties and recent changes impacting on investment buyers were all contributing factors to this trend. The arrival of spring has produced an increase in the number of properties being offered for sale, and any easing of covid restrictions will in the future ease the problems associated with client contact and property viewing.

The escalation in prices is easy to understand when we consider the imbalance of supply and demand. The various forms of the media and industry leaders such as REINZ are also active in promulgating news regarding the housing market. For example, we quote some recent media headings: –

- “Normally we’d have 1,400 homes for sale but we’re 600 short” (statement attributed to the North Shore but which could also apply elsewhere).

- Remuera home bought for $180,000 in 1984 fetches $3.84M after a big auction fight. (Similar trends are evident in Wellington although auctions are not so popular here).

- $1M+ properties still holding strong (REINZ). Indeed, they are with 1,634 sales of $1M or above in August 2020 and 2,200 in August 2021.

- Spring house listings rise but supply remains tight (Dom Post 2/10/2021). Yet another professional opinion recognising the imbalance of supply and demand.

New Zealand’s property market has always been cyclical, and some future market corrections are inevitable, but when and to what magnitude? A leading bank economist is predicting house prices will start declining as interest rates “get back to something more like normal” and tax changes aimed at evening the playing field between owner-occupiers and investors come into force. Also, the Reserve Bank has signaled that an increase to the Official Cash Rate is in the offing and this will impact on interest rates – but to what degree?

Tommy’s take the view that any mortgage interest rate increases will not be large and will be spread over time. The last scenario the country needs is another pressure being applied to homeowners on top of Covid restrictions. Any government action that would lead to added family pressure and even forced sales must surely be avoided at all costs!

Taking a positive position, Tommy’s summation of the market in coming months is that it is likely to follow the following pattern:

- The supply of properties will continue to be tight although new builds now under construction or on the drawing boards will eventually alleviate this position. In particular, there are a number of apartment developments underway, and these are proving popular with first home buyers.

- We will see further price increases but at a slower rate than experienced in recent months.

- A market correction cannot be discounted but we do not expect that to be large. We believe that we have reached a new level in the pricing structure and that is likely to be our future benchmark.

- Added to our current demand levels are a further 30,000-odd people trying to return to NZ via our MIQ facilities. These people all need to be housed and will add to the current level of buyer pressure and provide competition that will keep prices at or near to current levels.

In closing, we thank our clients for assisting us in following the Covid regulations during our interaction with you and doing what is best to keep NZ safe. We invite you to give your Tommy’s agent a call and discuss your next real estate move with us. We are here to help.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal