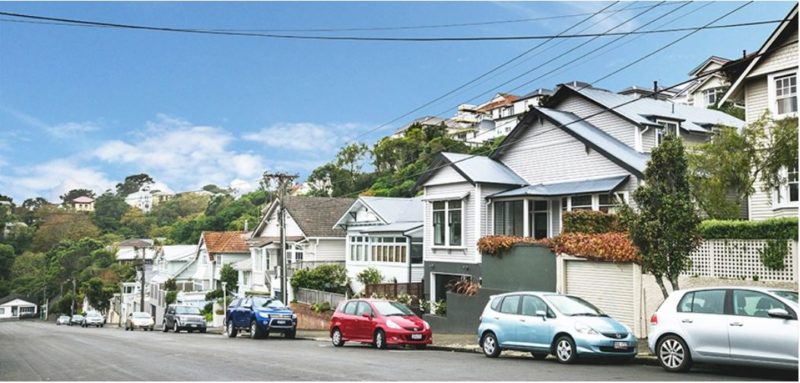

Buyers currently active in the market place won’t need to be reminded of the pressures they’re facing while competing in today’s red hot market. We doubt that the current level of competition has ever been higher! In this environment, buyers understand the need to make their offers as competitive as possible but the willingness to do so also needs to be tempered with a degree of caution. Taking short cuts may win the prize but may also create problems for an overzealous buyer who over commits financially or fails to carry out a thorough and sensible due diligence exercise before committing to buy.

In this article, we will cover the main issues that a potential buyer should take into account when looking for a property to buy and in formalising a competitive offer.

It’s never too early in the buying process to commence an exercise that makes you market savvy. This process involves an in-depth study of the market to acquaint yourself with market values; there is no better way to do this than by visiting open homes and gaining a feel for what you can expect to buy within the constraints of your budget. Checking on properties that have sold recently in your area of interest is also useful, though the recent rapid escalation of sale prices needs to be factored into your thinking also. Having an appreciation of what represents market value and seeking advice from your Tommy’s agent enables a buyer to commit to the level of any offer you make with a greater degree of confidence.

The pre-purchase period is also a useful time to familiarise yourself with a Sale and Purchase Agreement as this is the document that is usually used to consummate a property sale in New Zealand. The agreement is in a form approved by the Auckland District Law Society and the Real Estate Institute of NZ and is designed to cover all aspects of a sale and purchase and to protect the legal interests of both parties. Most conveyancing solicitors have an intimate knowledge of this document, so it’s a good time to strike up a working relationship with your legal adviser. He or she will guide you and suggest any additions or deletions you should make to cover your particular circumstances.

Your solicitor will also search the title to the property in question. The title document will reveal any matters that may impact on your legal ownership and rights of use. These items may include all or any of the following:

EASEMENTS: An easement is a legal right for another party (for example utility companies for drainage, power, water or gas) to utilize or access the property.

COVENANTS: A restrictive covenant may relate to any limitations on fencing, the size or height of the house or any structures on the land or it may, as an example, protect existing trees.

CAVEATS: A caveat indicates that another party has an interest in the property. A property owner is restricted from selling until such times as the caveat is satisfied or withdrawn.

These are just some of the basic reasons why a solicitor needs to check the current property title before you make an offer to buy.

This is also a good time to arrange finance so that you are aware of exactly what your upper buying limit is and you don’t over commit. By using an experienced mortgage broker you will take advantage of the current competitive rates on offer which may not necessarily be through the bank you currently deal with. Being ‘finance approved’ also enables you to remove this condition from any offers you make. Before committing to a finance arrangement though it is wise to consider your ability to meet your loan commitments should situations change to your detriment. This may be through redundancy, ill health, loss of a partner’s income or increasing interest rates. Always allow a safety margin and perhaps even consider insuring against unexpected loss of income through any unexpected contingency.

At Tommy’s, we understand the frustration that buyers are facing on today’s market but urge anyone in this category not to give up hope. Making offers can be costly and all to no avail, but ensure that in your preparatory work and before offering on a property you assess the need for any specialist reports. This may be a builder’s report, an engineer’s report or similar. A thorough examination of the Land Information Memorandum (LIM) pertaining to the property and other accessible council records is also advised. This will show if there are any unauthorized works on the property, any outstanding compliance issues and among other important matters if there are any outstanding commitments for rates or water rates, etc.

This is merely a brief summary of some of the important matters to consider when formulating an offer to buy. The key is to do your homework, understand the selling process and don’t take shortcuts or risks. Make your offer as competitive as possible both in terms of price and conditions but remember it is very easy in the heat of the moment to over commit. For further guidance on this important facet of homeownership Tommy’s recommend buyers study the website, www.settled.govt.nz.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal