NEW GOVERNMENT policies to try to take the heat out of the housing market are having mixed results, Tommy’s Real Estate Sales Director Nicki Cruickshank says.

“There are some signs of change, with definitely fewer people in the market — there’s been a drop-off in both investors and first-time buyers.

“But demand is still high because we simply do not have enough houses on the market.”

From October 1, investors will no longer be able write off their interest costs against the tax on their rental income (those who settled before March 27 2021 can still claim interest on pre-existing loans as an expense against residential property income but this will be phased out over the next five tax years).

“We have seen a notable number of investors initially withdraw from the market while they took stock of the changes to assess the financial impact on of being unable to claim their biggest cost,” Nicki says.

“It appears to have affected those families that were looking to buy an investment property heading towards their retirement.

“It doesn’t appear to have had the same affect on those investors with multiple properties.

“It is still too early to see what effect it will have on the number of rental properties going forward.”

The Government’s also doubled the ‘brightline’ test to 10 years but will retain the five-year test for new builds. “So there is now more of an incentive to buy new houses,” Nicki says. “Hopefully, this will improve the quality of rental stock.”

The Government’s new housing package also included $3.8 billion for a Housing Acceleration Fund aimed at enabling thousands of new homes by footing the bill for pipes and roads to support housing development. “Developers already have been addressing the housing shortage, with record sales off-plan of both townhouses and apartments in the last two years, and a steady increase over the last five years,” Nicki says.

“An example of this is the skyline in Victoria Street. There are now three new tower blocks of apartments, another is under construction directly across the road and one is near completion just 200 metres down the street.

“These alone have introduced a further 350 properties into the growing Wellington market.”

At the same time, however, there’s been a decline in first-time buyers, Nicki says. “The most notable change in the market has been the drop off in first-home buyers. “It feels like the market has got to a point where some potential buyers have simply had to drop out as they just cannot afford to buy a property as the market grows faster than they can save.”

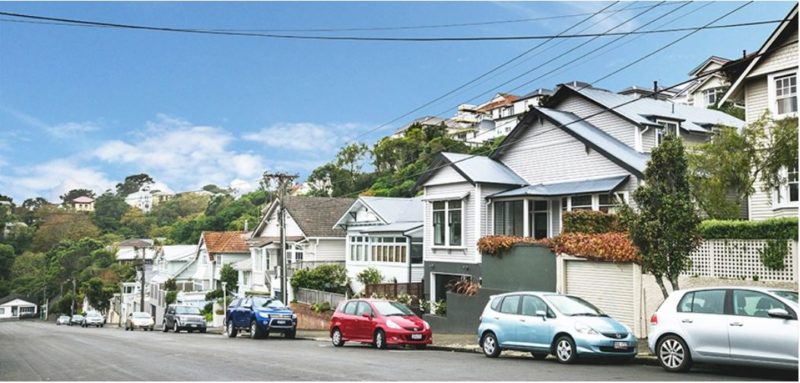

She says these buyers may be looking further afield, to suburbs with new low-maintenance living townhouses. “When a young person or couple cannot buy a two-to-three bedroom home easily in Wellington City for under a million dollars, then we will see a significant shift in this demographic out further, to Petone/Hutt Valley, Mana and the Kapiti Coast.

“I think we will see a big increase in developments of townhouses in these areas in the near future.

“It will be good for the regions to get an influx of younger people, but I’m not so sure it will be good for Wellington City and its businesses.

Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal