MARKET COMMENT AS AT 19th August 2020

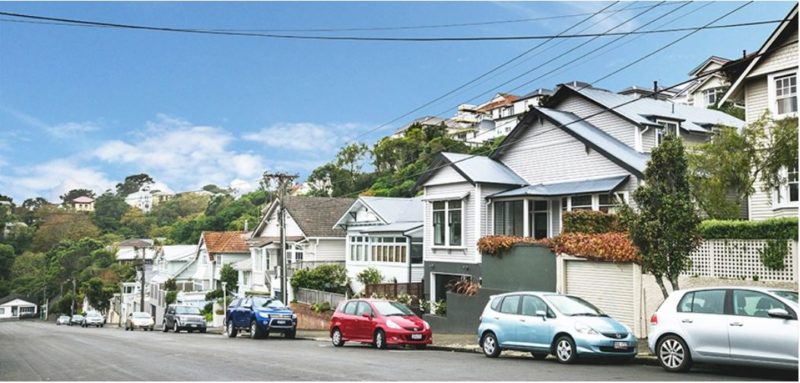

The latest news release from the Real Estate Institute of New Zealand (REINZ) supports Tommy’s opinion that we are experiencing a period of high demand that is perhaps unprecedented during the winter months. On 14th August, the REINZ Chief Executive reported “New Zealand’s property market continued to defy expectations in July with sales volumes increasing by 24.6% when compared to the same time last year. This was the largest annual percentage increase in sales volumes we’ve seen for the country since September 2015, highlighting just how confident the market was during July.” It is evident that the Covid19 cloud hanging over us has not dampened the enthusiasm or confidence of the general public when it comes to investing in property. Although the REINZ comments reflect the NZ wide situation, Tommy’s are finding that demand is high in and around Wellington and we share the problem of most agencies nationwide of not having enough property to sell to cash guaranteed buyers. Tommy’s are experiencing good attendances at open homes despite the limitations of physical distancing and many properties are attracting multiple offers; a situation fuelled by strong demand on the back of historically low mortgage interest rates. With the Official Cash Rate likely to remain at or around current levels, it is difficult to see this situation changing dramatically in the coming months. Although it is perhaps a difficult market for first home buyers, it is doubtful that the situation will get any easier in the foreseeable future. For home sellers, Tommy’s marketing plan and the support of our large and motivated sales force will ensure that your property gets the coverage it deserves and the best possible outcome from the current sellers’ market.Connect me with a local expert

Whether you’re ready to sell or looking for answers, we’ll guide you with data-driven strategy paired with over 20 years of industry experience

Book a free appraisal