If we turn the clock back to January of this year, nobody would have thought that in the coming months, our city, our country and in fact the entire world would be encountering the biggest threat to humanity that we have experienced for many years with COVID-19. To say that we have been a nation in turmoil would be an understatement as we encountered and worked through unprecedented changes to our working and living practices and as we hunkered down in our individual bubbles to avoid the spreading of this highly contagious virus. As long as we live we will all remember the year 2020 and its trials and tribulations that we unexpectedly encountered and met head-on.

Being the resilient lot that we are, it is time to ‘climb back on the horse’ and attempt to pick up the threads of normality; to return as close as we are able, to the lifestyle that we enjoyed prior to this upheaval in our lives. During the lockdown there was much speculation as to how this phenomenon would affect our lives and the ramifications it would have on the economy and in particular, on the real estate market. Tommy’s obviously has a keen interest in this topic and although we are speculating to a degree, we offer some suggestions as to how the coming year may play out from a housing perspective.

Being the resilient lot that we are, it is time to ‘climb back on the horse’ and attempt to pick up the threads of normality; to return as close as we are able, to the lifestyle that we enjoyed prior to this upheaval in our lives. During the lockdown there was much speculation as to how this phenomenon would affect our lives and the ramifications it would have on the economy and in particular, on the real estate market. Tommy’s obviously has a keen interest in this topic and although we are speculating to a degree, we offer some suggestions as to how the coming year may play out from a housing perspective.

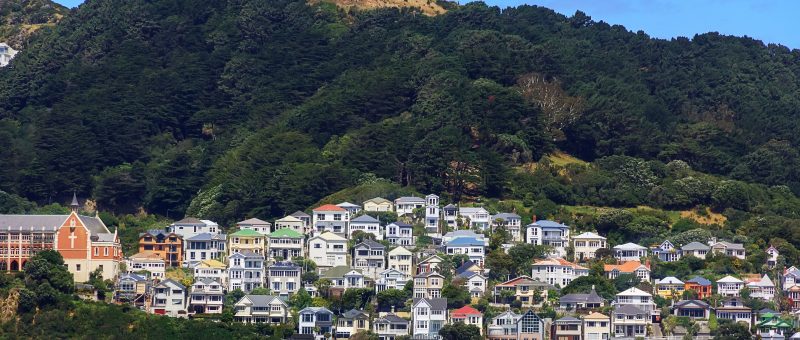

Many market commentators are predicting a reduction in house prices, some as high as into double-digit figures. Whilst this may be true of some areas, we doubt that residential property in Wellington and its environs will see a reduction of this magnitude. Sales that have been transacted during COVID alert levels 4 and 3 are encouraging and show little evidence of any material shift in pricing levels. Wellington is notorious for its reliable real estate market; we don’t rely heavily on tourism and our city will continue to attract home buyers moving to the Capital to further their educational and employment opportunities. An easing of the loan to value ratios will also be of assistance to first home buyers. In our view, there are a number of key pointers that will influence the direction the real estate market takes post coronavirus:-

Unemployment: This is a key factor and for the huge number of people who have lost their main source of income, the housing future must be uncertain. There is little doubt that some homeowners will be forced to sell their homes due to an inability to meet mortgage commitments while some first home buyers will be forced to put their homeownership aspirations on hold until such time as there is greater employment stability.

Finance: We doubt that mortgage finance has ever been available on more favourable terms than today’s generous rates. Government policy and Reserve Bank directives seem likely to maintain these interest rates for some time to come. The banks have also taken a sympathetic view providing, for example, ‘interest holidays’ to those requiring financial relief. This is obviously a huge help in the short term but borrowers need to realise that any deferred costs will still be waiting for their attention further down the track!

Migration: With the borders closed, it is likely that the housing market will be almost completely devoid of migrant buyers. It is difficult to see any relaxation in immigration criteria in the foreseeable future that will encourage foreign residents to our shores. This may be countered to some degree by Kiwi’s and their families who have been living offshore making a permanent move back home, as NZ is perceived as a ‘safe haven’ by many. The lack of tourism will impact less on Wellington than other locations, though the absence of cruise ships will be noticed in the retail sector.

Housing Demand: Tommy’s predicts there may be some reluctance from both buyers and sellers to enter into property negotiations until such time as something approaching normality returns. That being said, there are a few key factors that will influence this:-

- There are some homeowners who will need to sell.

- Investors are being turned off by low term deposit rates and some will see real estate as an alternative investment vehicle.

- A softening of prices is possible in the short term but we expect the resilient Wellington market to recover quicker than most other areas in NZ.

- Demand for housing remains and there is still an undersupply of houses in NZ.

With a dramatic slow-down in international travel, it is likely that a number of current Airbnbs will be offered for sale rather than be allowed to sit vacant. This may create opportunities for more owner/occupier transactions. We have said many times and we say again, the real estate market is cyclical, and history has shown us that highs and lows in market activity have been a regular occurrence. Tommy’s is confident that anyone investing in residential real estate for the medium to long term will weather these fluctuations and 2020 could see some opportunities for buyers with foresight and time to wait for the value of their asset to increase. Tommy’s will be pleased to assist buyers and sellers with their housing objectives as we resume something resembling a normal life again.